Achieving financial success isn’t about luck or working non-stop—it’s about adopting smart financial habits that foster long-term stability and growth. While many people chase wealth, few understand the mindset and behaviors that set successful individuals apart. What do wealthy people do differently? How do they make financial decisions that secure their futures?

The key lies in disciplined habits, intentional choices, and strategic thinking. Below are the most impactful habits that differentiate the wealthy from those struggling financially. If you’re looking to transform your financial future, start by incorporating these principles into your daily life.

Avoiding Impulse Spending: The Power of Financial Discipline

One major factor that separates wealthy individuals from the rest is the ability to resist impulsive purchases. While it’s easy to be tempted by the latest gadgets, fashion trends, or luxury items, financially successful individuals prioritize needs over wants.

How Wealthy People Manage Their Spending:

- They create and follow a budget, ensuring every dollar is accounted for.

- They wait before making big purchases, often giving themselves time to assess if it’s truly necessary.

- They focus on long-term financial goals, rather than momentary gratification.

On the other hand, those who struggle financially often spend emotionally, making purchases based on temporary desires rather than financial strategy. Learning to delay gratification can be a game-changer in building lasting wealth.

Quality Over Quantity: Working Smarter, Not Just Harder

Many believe that working more hours guarantees financial success. However, the wealthy understand that productivity is about efficiency, not just effort. Instead of burning out by working long hours, they focus on high-impact activities that generate real value.

Strategies Wealthy People Use to Maximize Productivity:

- They leverage skills that bring the highest financial return.

- They outsource or delegate lower-value tasks to focus on higher-income opportunities.

- They continuously improve their expertise, making them indispensable in their industries.

Those who remain stuck in a paycheck-to-paycheck cycle often trade time for money without looking for ways to increase their earning potential. Wealthy individuals optimize their time, allowing them to grow financially while maintaining a balanced life.

Building a Financial Safety Net: The Art of Saving First

A critical habit of wealthy individuals is their commitment to saving and investing. They don’t wait until the end of the month to save whatever’s left—they pay themselves first by setting aside money for their future before spending on anything else.

Key Financial Safety Habits:

- Emergency funds: Wealthy individuals always have at least 3-6 months’ worth of living expenses saved.

- Consistent investing: They put money into stocks, real estate, and retirement accounts to ensure financial growth.

- Avoiding reliance on credit: Instead of turning to credit cards for unexpected expenses, they prepare in advance.

Those who struggle financially often spend first and save later, leading to cycles of debt and stress. Adopting a save-first mentality can drastically change financial stability.

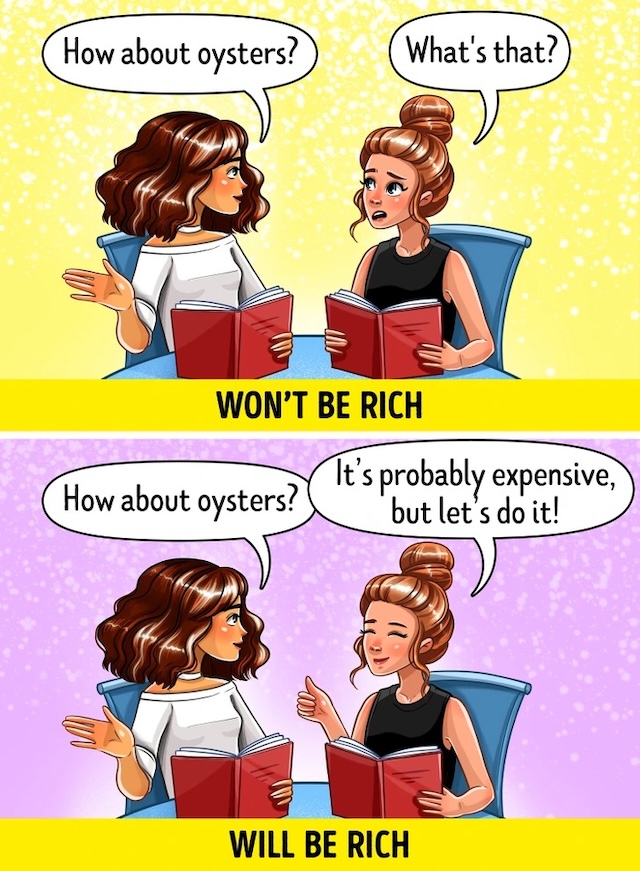

Embracing Calculated Risks: The Wealth Mindset

Wealth rarely comes from playing it safe. Successful individuals understand the value of taking calculated risks in investments, business, and career decisions.

How Wealthy People Approach Risk:

- They educate themselves before making financial moves.

- They diversify their investments, ensuring they aren’t dependent on a single source of income.

- They take calculated risks, balancing potential rewards with potential downsides.

Conversely, those who avoid all risks miss opportunities for financial growth, often staying in the same financial position for years. Learning to take smart, informed risks is essential for building long-term wealth.

Tracking Every Dollar: Staying in Control of Finances

Successful people don’t let money control them—they take full ownership of their financial situation. By tracking income, expenses, and savings, they ensure that every dollar serves a purpose.

Smart Money Management Habits:

- They use financial apps and budgeting tools to monitor spending.

- They review their finances regularly, adjusting plans as needed.

- They know exactly where their money goes, preventing wasteful spending.

Those who don’t track their finances often find themselves in a cycle of uncertainty, unaware of where their money is going. Taking full control of your finances is the first step toward financial freedom.

Setting Clear Financial Boundaries: The Power of Saying No

Wealthy individuals set strong financial boundaries, ensuring that their money aligns with their goals. They say no to unnecessary expenses, poor financial advice, and distractions that don’t serve their long-term success.

Ways Wealthy People Maintain Financial Discipline:

- They avoid peer pressure spending, making financial choices based on their goals, not social expectations.

- They set limits on lending money to family and friends if it jeopardizes their financial health.

- They prioritize investing over luxury spending, ensuring long-term wealth accumulation.

On the other hand, financially struggling individuals often overextend themselves, saying yes to purchases or commitments they can’t afford. Learning to set firm financial boundaries helps secure a stable future.

Avoiding Debt-Driven Lifestyles: Living Below Their Means

Wealthy individuals understand that true financial freedom comes from living within their means. They avoid debt-fueled indulgences, choosing to save for luxuries rather than relying on credit.

How the Wealthy Avoid Unnecessary Debt:

- They use credit responsibly, only borrowing for investments that generate income (like real estate or business growth).

- They save for large purchases instead of buying on impulse with debt.

- They minimize unnecessary expenses, ensuring they aren’t trapped in financial obligations.

Many people struggling financially fall into the trap of buying now and paying later, creating long-term financial stress. By prioritizing debt-free living, financial independence becomes easier to achieve.

Investing in Continuous Learning: The Key to Long-Term Success

One of the most defining habits of wealthy individuals is their commitment to lifelong learning. They never stop acquiring knowledge, whether it’s about investing, career growth, or personal development.

How Wealthy Individuals Prioritize Learning:

- They read books on finance, business, and success.

- They attend seminars, workshops, and networking events to expand their knowledge.

- They learn from mentors and successful individuals, absorbing wisdom from those ahead of them.

Those who ignore self-improvement often find themselves falling behind, limiting their career and financial potential. Investing in personal and professional growth is a non-negotiable habit for building wealth.

Final Thoughts: Adopting the Habits of Financially Successful Individuals

Wealth isn’t just about how much money you make—it’s about how you manage, invest, and grow your resources. Successful individuals follow disciplined financial habits, ensuring their money works for them rather than against them.

By adopting habits such as mindful spending, calculated risk-taking, continuous learning, and financial discipline, you can take control of your financial future. The path to wealth isn’t reserved for a select few—it’s available to anyone willing to make intentional choices and long-term commitments.

Start today. Shift your mindset, embrace new habits, and take the first step toward financial freedom.